Bank of America of is one of the most recognized names in the financial world, standing as a cornerstone of modern banking in the United States and beyond. With a legacy that dates back over a century, this institution has grown into a global powerhouse, offering a wide array of financial services to individuals, businesses, and governments. Whether it’s personal banking, wealth management, or corporate solutions, Bank of America has positioned itself as a leader in innovation, customer service, and financial stability. Its commitment to adapting to changing economic landscapes and technological advancements has earned it a reputation as a trusted partner for millions of customers worldwide.

For decades, Bank of America of has been at the forefront of reshaping the financial industry. From its early beginnings as a regional bank to its current status as a Fortune 500 giant, the institution has consistently demonstrated its ability to evolve and thrive. With a vast network of branches and ATMs across the U.S., as well as a robust online and mobile banking platform, Bank of America ensures accessibility and convenience for its customers. This adaptability has been key to its success, allowing it to remain competitive in an ever-changing market.

Today, Bank of America of is more than just a financial institution; it’s a symbol of resilience and innovation. The bank has embraced digital transformation, sustainability initiatives, and community engagement, making it a model for other financial institutions. Its dedication to fostering economic growth, supporting underserved communities, and addressing environmental challenges has further solidified its role as a leader in the banking sector. As we delve deeper into its offerings, history, and impact, we’ll uncover what truly makes Bank of America a pillar of modern banking.

Read also:Are Natalie Herbick And Gabe Spiegel Married Discover The Truth Behind Their Relationship

Table of Contents

- What Are the Origins of Bank of America of?

- How Does Bank of America of Serve Its Customers?

- Why Is Bank of America of a Leader in Digital Banking?

- What Role Does Bank of America of Play in Global Finance?

- How Does Bank of America of Support Sustainability?

- What Are the Challenges Faced by Bank of America of?

- How Does Bank of America of Engage with Its Community?

- What Does the Future Hold for Bank of America of?

What Are the Origins of Bank of America of?

Bank of America of traces its roots back to 1904 when it was founded as the Bank of Italy in San Francisco. Established by Amadeo Giannini, the bank initially aimed to serve the financial needs of immigrant communities who were often overlooked by traditional banks. Giannini’s vision of inclusive banking laid the foundation for what would eventually become one of the largest financial institutions in the world. Over the years, the bank underwent several mergers and acquisitions, including its transformation into Bank of America in 1930 and its merger with NationsBank in 1998, which solidified its status as a national leader.

The institution’s growth was fueled by its ability to adapt to economic changes and expand its services. From introducing the first credit card in the 1950s to pioneering online banking in the 1990s, Bank of America of has consistently been a trailblazer in the financial industry. Its commitment to innovation and customer-centric solutions has been a key driver of its success, allowing it to maintain its relevance in an increasingly competitive market.

Today, Bank of America of operates as a multinational corporation with a presence in over 35 countries. Its journey from a small regional bank to a global financial giant is a testament to its resilience, vision, and ability to evolve. This rich history not only highlights its contributions to the banking sector but also underscores its role in shaping the financial landscape of the modern world.

How Does Bank of America of Serve Its Customers?

Bank of America of is renowned for its comprehensive suite of financial products and services, designed to meet the diverse needs of its customers. Whether you’re an individual looking for personal banking solutions or a business seeking corporate financial services, the bank offers tailored options to ensure customer satisfaction.

Personal Banking Services

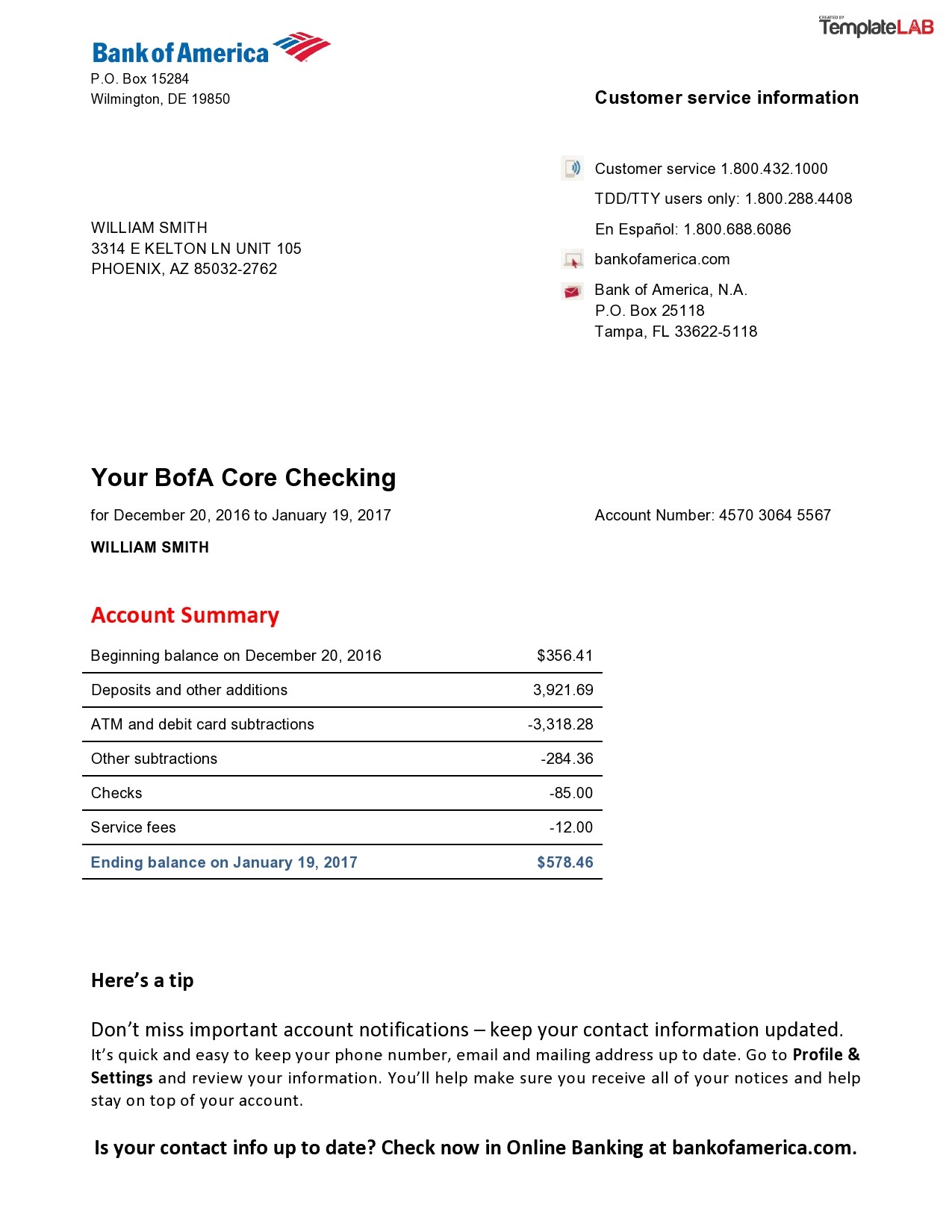

For individual customers, Bank of America of provides a wide range of personal banking services, including checking and savings accounts, credit cards, loans, and investment products. Its mobile and online banking platforms make it easy for customers to manage their finances on the go, offering features like bill pay, account transfers, and real-time transaction alerts. Additionally, the bank’s extensive network of branches and ATMs ensures that customers have access to their money whenever and wherever they need it.

One of the standout features of Bank of America of’s personal banking services is its focus on financial wellness. Through tools like the “Better Money Habits” program, the bank empowers customers to make informed financial decisions by providing educational resources and personalized advice. This commitment to financial literacy sets Bank of America apart from many of its competitors.

Read also:Is Kevin Eudy Married Unveiling The Truth About His Personal Life

Business and Corporate Solutions

On the business side, Bank of America of offers a variety of solutions tailored to the needs of small businesses, corporations, and government entities. These include business checking accounts, merchant services, treasury management, and commercial lending. The bank also provides specialized services such as global trade financing and risk management, helping businesses navigate the complexities of international commerce.

For larger corporations, Bank of America of’s investment banking arm, BofA Securities, offers advisory services, capital raising, and market insights. This division plays a crucial role in supporting businesses with their growth and expansion strategies. By combining its expertise in traditional banking with cutting-edge financial technologies, Bank of America of continues to be a trusted partner for businesses of all sizes.

Why Is Bank of America of a Leader in Digital Banking?

In today’s digital age, Bank of America of has established itself as a leader in digital banking, leveraging technology to enhance customer experiences and streamline operations. The bank’s online and mobile platforms are designed to be user-friendly, secure, and feature-rich, offering customers unparalleled convenience and accessibility.

One of the key innovations introduced by Bank of America of is its virtual assistant, Erica. Powered by artificial intelligence, Erica helps customers with tasks such as checking account balances, transferring funds, and even providing personalized financial advice. This AI-driven tool has revolutionized the way customers interact with their bank, making banking more intuitive and efficient.

Additionally, Bank of America of has invested heavily in cybersecurity to protect its customers’ data and ensure the integrity of its digital services. By adopting advanced encryption technologies and implementing rigorous security protocols, the bank has set a benchmark for digital banking safety. Its commitment to innovation and security has earned it numerous accolades and solidified its position as a leader in the digital banking space.

What Role Does Bank of America of Play in Global Finance?

Bank of America of is not just a domestic player; it plays a significant role in the global financial ecosystem. With operations spanning over 35 countries, the bank serves as a bridge between markets, facilitating international trade, investment, and economic growth. Its global presence allows it to offer a wide range of cross-border financial services, including foreign exchange, trade finance, and global treasury solutions.

Through its investment banking division, Bank of America of provides advisory services and capital-raising solutions to governments, corporations, and institutions worldwide. This division has been instrumental in supporting large-scale projects, mergers, and acquisitions, contributing to the development of economies across the globe. The bank’s expertise in navigating complex financial landscapes has made it a trusted partner for clients seeking to expand their international footprint.

Moreover, Bank of America of is actively involved in addressing global challenges such as climate change and economic inequality. By leveraging its resources and influence, the bank is working to create a more sustainable and inclusive financial system. Its global initiatives reflect its commitment to making a positive impact on the world while maintaining its position as a leader in the financial industry.

How Does Bank of America of Support Sustainability?

Sustainability is a core pillar of Bank of America of’s corporate strategy. The bank has made significant commitments to addressing environmental challenges and promoting social responsibility. One of its most notable initiatives is its $1 trillion environmental business commitment, aimed at financing sustainable projects and supporting the transition to a low-carbon economy.

Bank of America of also plays a leading role in green financing, offering products such as green bonds and sustainable loans. These financial instruments are designed to fund projects that have a positive environmental impact, such as renewable energy installations and energy-efficient infrastructure. By aligning its financial services with sustainability goals, the bank is helping to drive meaningful change on a global scale.

In addition to its environmental efforts, Bank of America of is committed to fostering economic inclusion and addressing social inequalities. Through programs like the Neighborhood Builders initiative, the bank invests in underserved communities, providing resources and support to local nonprofits. These efforts underscore the bank’s dedication to creating a more equitable and sustainable future.

What Are the Challenges Faced by Bank of America of?

Despite its success, Bank of America of faces several challenges in today’s rapidly evolving financial landscape. One of the primary challenges is regulatory scrutiny. As a major financial institution, the bank is subject to strict regulations aimed at ensuring financial stability and protecting consumers. While these regulations are essential, they can also create operational complexities and increase compliance costs.

Another challenge is the rise of fintech companies, which are disrupting traditional banking models with innovative digital solutions. These companies often have the advantage of agility and lower overhead costs, allowing them to offer competitive products and services. To stay ahead, Bank of America of must continue to invest in technology and innovation while maintaining its focus on customer satisfaction.

Finally, the bank must navigate the economic uncertainties brought about by factors such as inflation, geopolitical tensions, and climate change. These challenges require a strategic approach to risk management and a commitment to long-term resilience. By addressing these issues head-on, Bank of America of can continue to thrive in an increasingly complex and competitive environment.

How Does Bank of America of Engage with Its Community?

Community engagement is a cornerstone of Bank of America of’s corporate philosophy. The bank believes in giving back to the communities it serves, investing in programs and initiatives that promote economic mobility, education, and social justice. Through its philanthropic efforts, Bank of America of has donated billions of dollars to support nonprofits and community organizations across the globe.

One of the bank’s flagship programs is the Neighborhood Builders initiative, which provides leadership training and funding to nonprofit leaders in underserved communities. This program has empowered hundreds of organizations to expand their impact and address critical social issues. Additionally, Bank of America of supports educational initiatives, such as scholarships and workforce development programs, to help individuals achieve their full potential.

The bank also encourages its employees to volunteer their time and skills to support local causes. Through its employee volunteer program, Bank of America of fosters a culture of giving back, enabling its workforce to make a meaningful difference in their communities. These efforts demonstrate the bank’s commitment to being a responsible corporate citizen and a force for good in society.

What Does the Future Hold for Bank of America of?

As Bank of America of looks to the future, it remains focused on innovation, sustainability, and customer-centric solutions. The bank is poised to continue its leadership in digital banking, leveraging emerging technologies such as blockchain, artificial intelligence, and machine learning to enhance its